Strike price and intrinsic value

When you use the intrinsic value calculator, the value of Disney is $40.46 when compared to the 10-year federal note. What does that mean? Wintoflash para mac. If you could buy Disney right now for $40.46, we estimate you get a 1.7% annual return on your money for the next 10 years. Intrinsic value calculator free download - Intrinsic Value Calculator, Intrinsic Value and CAGR Calculator, Intrinsic Value Calculator DIY, and many more programs. Intrinsic Value per Share: 8.0 = This is your estimate of how much the stock is worth using the relative valuation method! Currrent Share Price: 126.7: 74. Dec 10, 2014 What is Intrinsic Value of Share? We see that the price of a share goes up or down. But if we can calculate the real value of a stock that will be very helpful for the investors. In simple terms, the definition of intrinsic value of share is the discounted value that we can take out from a business during the rest of its life.

On the examples with Microsoft stock, we have explored the strike price and intrinsic value of call options and put options. To sum up and make it look a bit more scientific, let’s look at the formulas for calculating intrinsic value for calls and puts.

Calculating intrinsic value of call options

Incredimail 2 5 italiano crack. Call intrinsic value = MAX of (stock price less strike price OR zero)

Calculating intrinsic value of put options

Put intrinsic value = MAX of (strike price less stock price OR zero)

Learn the logic, not the formulas

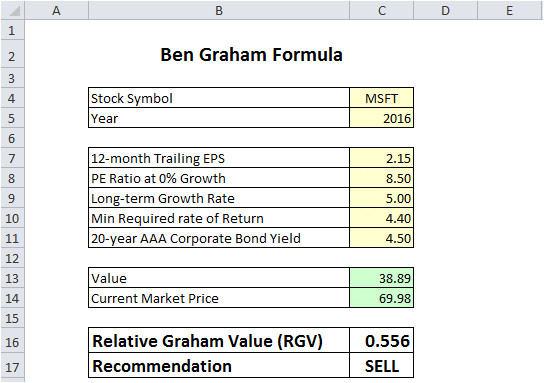

Intrinsic Value Spreadsheet

Nevertheless, the recommendation now is: do not memorize the formulas. Instead, focus on the logic and make this logic your natural way of thinking. For example, like this:

Intrinsic Value Calculator Excel Download

You have a call. – You are buying the stock. – You want to buy as low as possible. – Therefore, if strike is lower, option has greater intrinsic value.

Or consider a put. – You are selling. – You want to sell as high as possible. – …

Do not memorize. Understand.